Financial services customers using DueDil can now integrate company data and insights directly into their workflow. The London-based company information platform’s API can be integrated to automate the on-boarding process, boosting sell rates to 95 per cent.

“It’s a dramatic improvement,” says CEO Damian Kimmelman. “DueDil API makes it so much easier for businesses, especially in financial services, to on-board prospective customers and to know exactly who those businesses are. In financial services, you need to know who your potential customers are before you take them on as clients, looking at their financial health, as well as that of the individuals in the business.”

DueDil is working with a partner to integrate data on individual credit history to add greater depth to the analysis. On-boarding traditionally takes around 25 days, but now it takes around 30 minutes, says Kimmelman.

“The speed and ease of the process can really transform financial services and it provides a competitive edge to these financial services companies. It provides choice in the marketplace. Business customers can have more opportunities to move from one supplier to another, creates more competition,” he says.

One of DueDil’s banking customers reportedly spent around £5 million in integrating a competing company information platform’s API. “Turns out, it was extremely laggy and cumbersome to update and build on. When they switched over to us, the cost of integration was less than £100,000,” Kimmelman adds.

“A lot of people have been working on how to on-board individuals quickly, but not enough business have focussed on how to reduce the friction for private companies. This is the beginning of a new way of streamlining what was once a difficult process.”

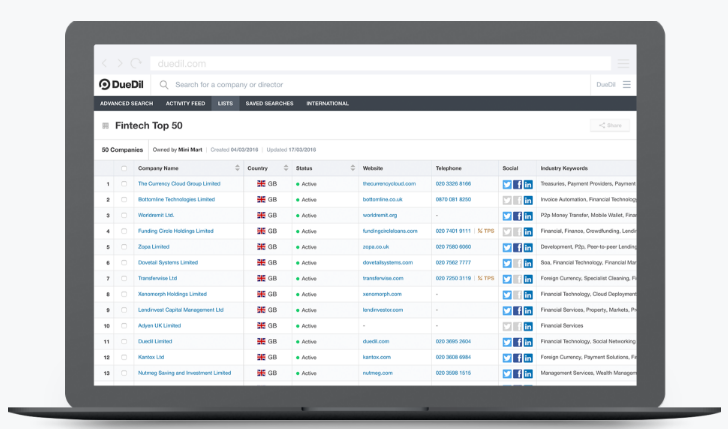

DueDil recently announced its aim to expand the coverage of its company data, which is set to enable new trade opportunities for millions of companies across the UK and Europe. At present, it maps information on over 11 million private and public companies, using official sources such as Companies House, and information about credit risk, group ownership, news alerts, and historic financials. Businesses use this information to make informed decisions, discover new trading opportunities and mitigate risk.

In 2016, DueDil received a Horizon 2020 Grant from the European Commission to aid its expansion across European markets. Over the next month, DueDil will expand coverage to an additional 29 million businesses across France, Germany, Benelux, and the Nordics, with more European companies to follow later this year. The additional European coverage will make it easier for businesses make more informed decisions on trade, discover new customers and help access liquidity across the continent.

For example, an alternative finance provider can now use the platform to better assess the risk of lending to a new German customer. A French-based distributor can use the platform to discover new prospects in the UK that fit their profile. Additionally, banks can use the information to better understand their business banking clients to help support their growth ambitions.

DueDil aims to have 100 million companies on its platform by the end of the year, and over 200 million companies globally by the end of 2018, while DueDil API is set to make the process faster and more efficient.