London is often touted as the eye of the European venture capital ecosystem. VC firms in the UK capital may have propelled countless successful tech start-ups to grow into household names over the past two decades, but there still remains a funding gap.

“A fair amount of investment is available in digital technology and apps, but very little is available to start-ups in industrial high tech,” Ilian Iliev, CEO of London-based VC firm, EcoMachine Ventures tells GrowthBusiness.

Iliev has always been interested in how innovation in financed, how entrepreneurs use patented technologies, and what makes for strong investment in the industrial high tech space. “The UK is very advanced in terms of innovative technologies in industrial applications, but there’s a huge gap in finance for industrial high tech companies. So much so, that the (HM Treasury Patient Capital) review on scale-ups also reveals this,” he says.

The UK ranks third in the OECD for business start-ups, with over 350,000 new businesses created every year. However, when it comes to attracting scale-up capital, the UK only ranks 13th in the OECD. This despite being home to one of the world’s most dominant financial centres.

Iliev founded EcoMachine Ventures in 2013 to address this puzzling gap.

“These industrial high tech start-ups could potentially provide very high investment returns,” he explains. “It’s not that we’ve discovered the industry; people have been driving cars and producing chemicals for decades. However, brilliant innovations are coming out of universities and labs all over the world, but they only have so much room to grow without more funding.”

The EcoMachine Ventures’ approach combines corporate venture capital, with private capital. “We co-invest with corporates like ABB, Philips, Mitsubishi among others, and build collaborations. Private investors benefit from this because involving corporates in backing start-ups at a very early stage of development mitigates a lot of risks. These big names are associated with these start-ups and their new technologies. As an investment proposition, it’s much more impactful that way. ”

“Our investment strategy triangulates exciting companies with innovative technologies, with corporate and private investors.”

So why is there such a gaping funding gap in this sector? Iliev believes it’s the same difference as owning a Ferrari or Aston Martin. “What’s sexier; a Ferrari or Aston Martin? With a Ferrari, you know what you’re getting, but with an Aston Martin, you might have to work on it a little longer, but its charm can last longer,” he adds. “If you’re backing consumer tech, it’s easy to put yourself in the customers’ shoes. You need more skills and sector knowledge to invest in industrial high tech.”

The uniqueness of the sector, according to Iliev, is that it is inherently hard-to-break in. “The sector is slightly less transparent and more hidden, which gives these start-ups space to develop without worrying about competition. But make no mistake. the market is huge.”

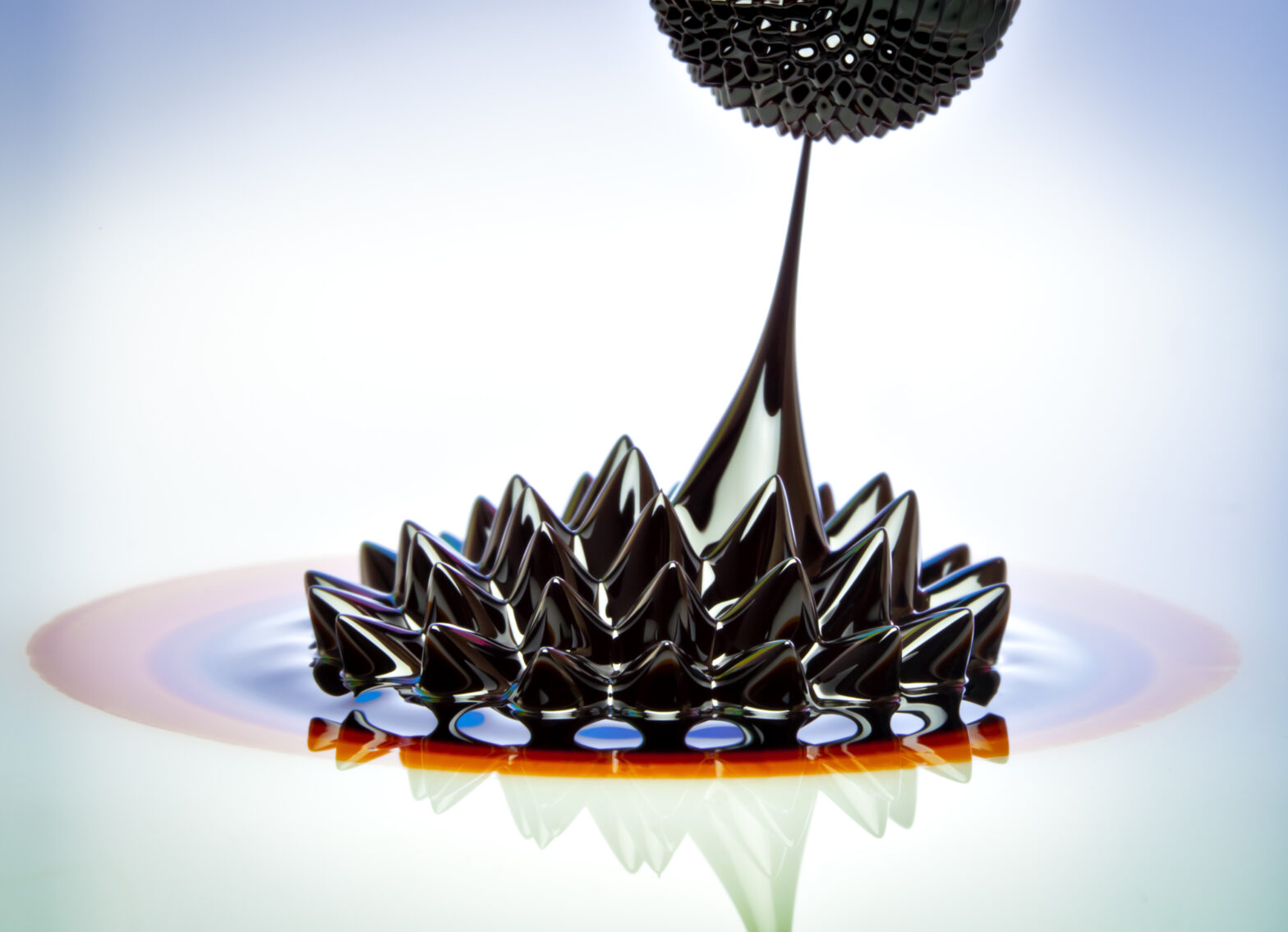

Industrial high tech refers to any high technology, such as robotics, nanotechnology and so on, that is used in industrial application, such as in the automotive industry, or renewables.

Currently, EcoMachine Ventures has six companies in its portfolio, with a profitable exit last year. American firm, Nanotechnology Industrial Solutions, is one of its portfolio companies, with uses nanotech to transform resource efficiency in industrial lubricants. “Everything, from buses to wind turbines use lubricants. Nanotechnology lubricants extends the lifecycle of equipment. For example, wind energy becomes cheaper as lubrication reduces down time,” Iliev explains.

Another company EcoMachine Ventures has backed is Israeli start-up, PointGrab, with is also supported by ABB and Philips Lighting. “PointGrab provides IoT smart sensors to the building automation industry, using micro-intelligence in office buildings. If you make a building smarter, it is more energy efficient, sustainable and comfortable for employees.”

London-based robotics company, Q-bot is the first robotics company to be certified by the British Building Association for being acceptable and ready to scale. The company sits firmly in EcoMachine Ventures’ portfolio. “They discovered what they thought is a very British problem is actually an international issue; underfloor insulation in Victorian buildings,” Iliev says.

“Q-bot uses robots to do jobs that shouldn’t be done by humans, such as crawling into small, unsafe spaces to spray chemicals. The start-up is also training up communities, and is a great example of how using robots can actually create new jobs for people.”

According to Iliev, the firm’s growing international portfolio is a testament to London’s lasting appeal as a city for tech growth. “Simply being here makes us attractive to start-ups all over the world. For UK start-ups, being in London gives them access to international networks, and for foreign start-ups, it’s a stepping stone into the UK.”

Despite Brexit, most companies the firm has spoken with see London as a landing spot. “The UK is also strong from a legal and patent protection perspective. Many industrial high tech companies are chronically under funded, so they tend to cheap out on filing for patents, opting for just UK-wide or Europe-wide patent instead of something global,” Iliev explains. “This can come back and bite them later on, when looking to exit. The defensibility of their position is a key factor that will affect their valuation. Early on, businesses should think about internationalisation and thinking about export markets. This is not news to Israeli, German or Chinese companies, but it’s a pretty different way of thinking for some UK businesses.”

Later this year, EcoMachines Ventures will be launching an EMV-advised EIS Fund focused on seed and series A investments in the UK.