Entrepreneurs and small business owners are thinking about selling up earlier than they had planned before chancellor Rishi Sunak hikes capital gains tax.

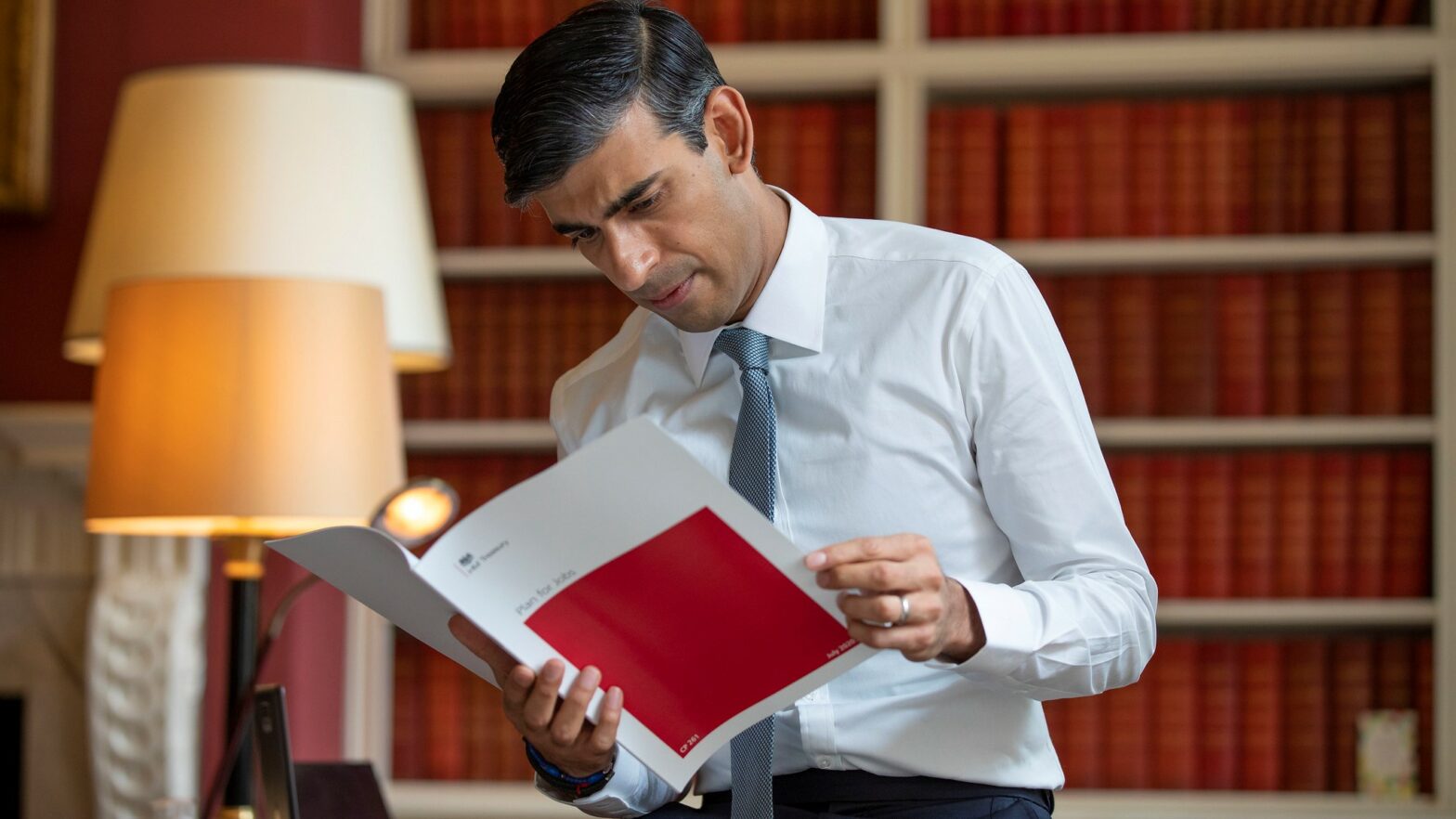

Mr Sunak is considering an overhaul of capital gains tax as he tries to find ways to pay for an expected £300bn cost of coping with the coronavirus pandemic.

Capital gains tax is levied on the profits made when an asset, such as a business which has increased in value, is sold. Typically, business owners are charged 20 per cent on the profits they make from selling on their companies, although entrepreneurs’ relief means that they have to pay only 10 per cent on the first £1m. The threshold used to be £10m, but the chancellor cut back that figure in March.

>See also: How to sell your small business without a broker – Growth Business guide

Former chancellor Alistair Darling introduced entrepreneurs’ relief as a way to encourage start-ups, although it is disputed as to whether it has ever affected any decision to start a business.

Mr Sunak’s review has spooked some business owners, who are worried that any tax rises or scrapping of the relief would put a dent in what, for many, is their retirement pot.

Lord Leigh of Hurley, co-founder of Cavendish Corporate Finance, told The Times: “They want to capitalise a bit earlier than they had otherwise planned if they possibly can.”

Chris Etherington, a private client tax partner at accounting group RSM, told the newspaper that he had also seen more clients enquiring about accelerating the sales process.

UK entrepreneurs have made £108.4 billion from the sale of their business or stakes in their business between 2012 and 2017, according to law firm Boodle Hatfield.

Those business sales generated over £12.2bn in capital gains tax for the Government in the same period, at an average of £2.4bn a year.

Further reading

How to sell your small business through a broker