Depending on whom you ask, European SMEs are on the growth path, despite the current political and economic volatility affecting much of the continent and export hotspots like the US. We cut through reams of research to bring you the highlights of growing in the age of uncertainty.

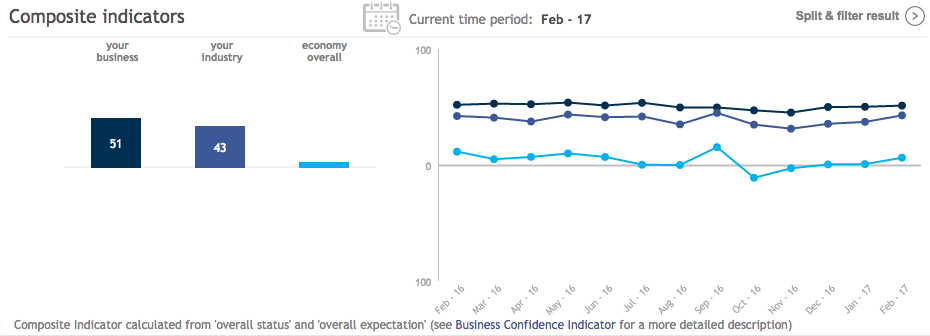

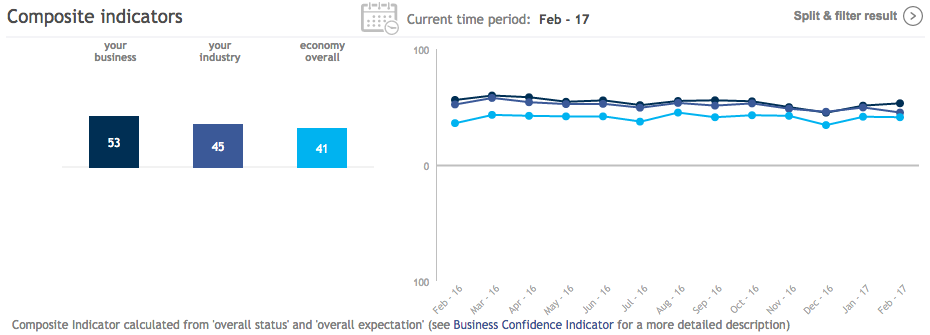

According to a monthly survey from Facebook, OECD, and The World Bank on the economic environment in which businesses around the world operate, February 2017 has seen an uptick in confidence and hope.

While the UK, France, Germany, Belgium, Italy, Spain and Greece seem to have low expectations for the economic outlook of their respective countries, businesses in the Netherlands and Sweden foresee big things for their economy.

India and the US are top export and expansion destinations for European businesses, and both markets have positive metrics in terms of business, industry and economic confidence.

Separate research from American Express delves into why these businesses are reportedly confident about their future business performance.

The research reveals that the majority of these Western European and American businesses are optimistic about the economy and believe they have the strategies in place to thrive in an age of uncertainty.

The research, carried out among senior executives and decision-makers in SMEs across 15 countries, reveals that SMEs globally and across Europe are confident in their ability to deliver increased revenues and profitability. Globally, 58 percent of SMEs surveyed expect significant revenue growth over the next 12 months. Almost fifty percent or more of SMEs in France, Germany, Italy, Spain and the UK anticipate revenue growth of at least 4 per cent over the next 12 months. 16 per cent or more of SMEs surveyed across Europe look forward to revenue growth of at least 8 percent over the same period.

In terms of profitability, SMEs in Europe are similarly upbeat with 52 per cent forecasting a net profit of 4 per cent per annum over the next three years. A further 19 per cent of European SMEs forecast net profits in excess of 8 per cent over the same period.

Healthy optimism

More broadly, SMEs across the globe are optimistic about the health of the world economy over the next 12 months, with SME decision-makers more than twice as likely to be positive than negative about the economic climate (39 percent positive versus 16 percent negative). This optimism is replicated at a European level, albeit to a diverse extent with SMEs in France and Germany respectively the least and most positive among the European SMEs surveyed.

Economic and political uncertainty seen as key challenges

With Brexit negotiations underway, French and German elections on the horizon, and the Trump presidency rocking the status quo in the US, political uncertainty is the only constant in these geographies. While SMEs are optimistic about the economy and their own business, they also identify areas for concern. Economic and political uncertainty in their home markets is seen as the largest threat to the business, both globally and in Europe. European SMEs are also concerned about uncertainty in their European export markets: 30 per cent identify this as a leading threat to business performance and European SMEs were in fact twice as likely to cite this as a concern as SMEs in the rest of the world.

Separate research into larger businesses in the UK from tech scale-up Anaplan reveals that more than 44 per cent of British businesses haven’t started planning for Brexit, even though the majority are concerned about its impact. The sample was drawn from UK organisations of 250 or more employees with a turnover of £50 million or more, of which only one in five put total faith in their CEOs in this time of volatility.

Focus on expansion and sales growth to drive financial performance

Despite uncertainty, SMEs globally and in Europe are focusing on growth and expansion strategies to improve their financial performance. 41 per cent of European SMEs say expansion into new domestic markets will be a top priority for their business over the next three years according to the American Express survey, while one in two businesses will make growing their share of current markets a key focus.

Exporting is a core pillar of many SMEs’ growth strategies globally and Europe is no exception: almost one third of European SMEs cite expansion into new international markets as a pathway to improved financial performance over the next three years. SMEs are confident they are ready for export growth, with half (50 per cent) of European SMEs strongly believing their company has the right plans in place to increase export sales. Most significant is the fact that over half of SMEs in Europe believe the timing is ripe to grow exports: interestingly 52 per cent agree it is easier to access new export markets than it was three years ago.

Seeking alternative sources of finance to fund growth

Many European SMEs struggle to finance the investment required for growth. Just over half (52 per cent) say they face difficulty accessing the finance they need to grow their business while 56 per cent say that inadequate cash flow affects their ability to pay suppliers on time. While just over half are satisfied to some degree with the current options available to their business, almost a quarter (23 per cent) are dissatisfied with their finance arrangements.

Today, most European SMEs rely on bank loans (57 per cent) and existing working capital (54 per cent) to fund their investment. Over the next year, SMEs plan to take advantage of a far more diverse set of funding options. Their existing funding arrangements will remain important, but many SMEs will also be looking to non-bank sources of finance such as private equity, crowdsourcing and cards to gain access to capital to grow.

Look beyond the short term

As part of the research, top executives in European SMEs were asked about the long-term goals of the business. While profit margin growth (53 per cent) and revenue growth (48 percent) are identified as the number one and two objectives respectively, well over a quarter (29 per cent) of Europe-based SMEs state that sustaining the business for future generations is an important long-term goal. Europe’s SMEs are more likely to take this long-term view than SMEs in the rest of the world (23 per cent of respondents outside Europe ranked sustaining the business for future generations as a top objective).

All of these pieces of research suggest a positive blanket approach from European SMEs, most of whom are focusing on expansion and growth opportunities, reaching out to new markets and customers at home and globally, despite the economic and political climate.

However, there also seems to be a worrying trend: many SMEs are finding it difficult to access the finance they need to invest in growth, suggesting a pressing need for Europe’s financiers to step up their offerings.

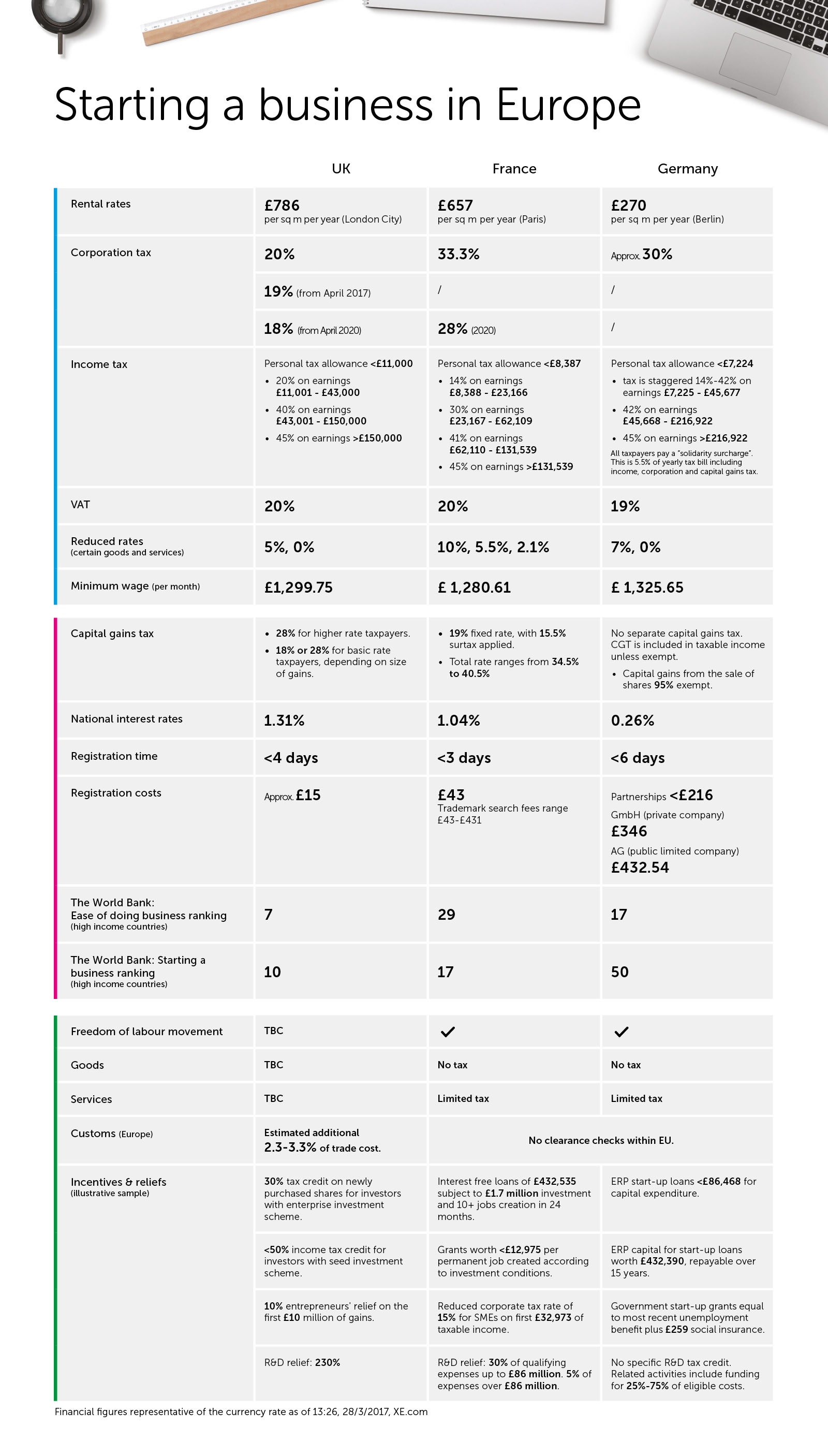

Taking a step back, aspiring entrepreneurs looking to start up in Europe may not see growth potential in the UK in the wake of Article 50 and impending Brexit. An infographic from Hiscox looks at the pros and cons of starting a business in the three biggest economies in Europe: the UK, France and Germany, in a post-Brexit scenario.