This article was originally published in the GrowthBusiness M&A Guide.

The M&A Guide is aimed at entrepreneurs and owners of growth companies, summarising the state of play of the dealmaking landscape and the various elements of the ecosystem over the past year. The aim is to help business owners understand whether a merger, acquisition, sale, or going public is right for their business, and the types of advisers and expertise they may require along the way.

Knowing when to go public

IPOs can take many months to execute so it’s critical to be thoroughly prepared. Many high growth companies are loss-making, or are only marginally profitable, but can still grow by going public. According to American consultancy, Hedgeable, 78% of recent Initial Public Offerings (IPOs) are for companies that can’t break even. This is not an obstacle for floating as long as you can demonstrate sustainable growth, a credible path to profitability and a strong and reliable management team that investors can believe in.

When do you know you’re ready?

Although further expansion is a benefit to the company, there are both advantages and disadvantages that arise when a company goes public. Small companies looking to further growth often use an IPO as a way to generate the capital needed to expand. When deciding whether or not to go public, companies must evaluate the pros and cons during the underwriting process, which is done with the expertise of an investment bank.

Which market is best for your business?

The US has traditionally been the promised land for high growth technology companies, but in recent years, London has started to challenge American exchanges, with the IPOs of Worldpay, AutoTrader and Sophos in 2015. Additionally, London is unique in its choice of markets for companies at various stages of their growth cycle, such as the Alternative Investments Market (AIM) and the Main Market, which includes a high growth segment.

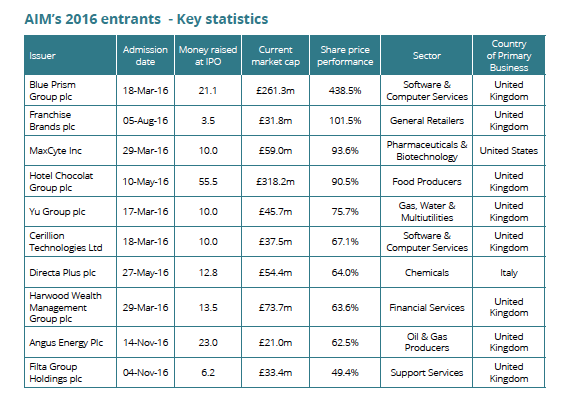

2016: a strong year for AIM

The Alternative Investment Market (AIM) is arguably the world’s most successful growth market, having rounding out 2016 on a high as the 38 companies that floated on the market ended the year up more than 39 per cent on average. In addition, 263 companies, already quoted on AIM raised more than £3.8 billion in further fundraising, underlining the market’s capacity to act as a vital source of permanent growth capital.

Since its launch in 1995, AIM, now in its 21st year, has allowed companies from across the UK and around the world to raise nearly £100 billion in new and further fundraising. Just this year we have seen companies from across the UK, including businesses from Scotland and Wales, as well as household names such as fashion retailer, Joules; chocolatier, Hotel Chocolat and publisher, Time Out Group.

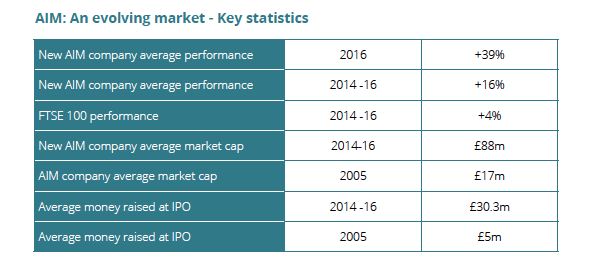

The success of companies floated in 2016 builds on similarly strong price performance of IPOs over the last three years: +16 per cent on average. The last three years have also seen the nature of new AIM companies evolve. Compared to 10 years ago, the average new AIM company is significantly larger: £88 million market cap versus £17 million in 2005, raising more capital: £30 million versus £5 million in 2005.

“As IPO markets worldwide experienced a challenging 2016, AIM again demonstrated why it is recognised as the world’s leading growth market,” Marcus Stuttard, head of AIM and UK primary markets at the London Stock Exchange says.

Now in its 21st year, AIM has come of age as a market as the nature and performance of this year’s IPOs illustrates. AIM is fulfilling its promise: a global market successfully connecting the real economy: ambitious, small and mid-cap growth companies to institutional and retail investors.”

AIM: An evolving market – Key statistics

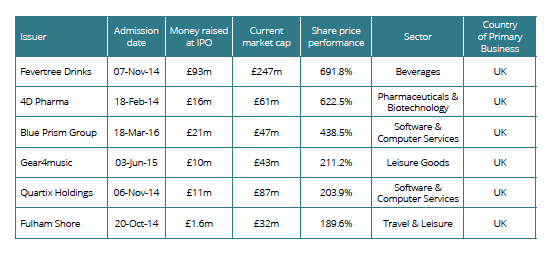

Top performing new AIM companies 2014-16

Of particular note has been the variety of the highest performing new AIM companies over the last three years. They operate in sectors as diverse as beverages to high end software and IT. Interestingly too, they all joined AIM with relatively large initial market capitalisations, demonstrating the market’s ability to fund high growth mid-caps as well as smaller businesses.

The M&A Guide 2017 is supported by Clydesdale & Yorkshire Bank, EMC, Kingston Smith, Knight Corporate Finance, and Squire Patton Boggs. To read more, download the guide for free here.