Fuel3D, a developer of 3D scanning solutions, has closed a funding round of £4 million ($6.4 million), building on the company’s initial £1.6 million (£2.6 million) funding secured earlier this year.

The investment paves the way for the commercial launch of the company’s consumer scanner product in 2015.

The funding will be used to ramp up Fuel3D’s production, customer support and international retail distribution.

In addition, Fuel3D will use the funding to expand the scope of the company’s technology to address commercial opportunities in a range of vertical markets through its Fuel3D Labs division, including biometrics and eyewear.

Ben Gill of Chimera Partners says, ‘The initial interest shown by investors in Fuel3D has only been increased since the first funding round and we are very pleased to have been oversubscribed in this round of fundraising.

‘The company continues to impress with its commitment to product development goals and has also made very significant inroads into developing new commercial applications and relationships.’

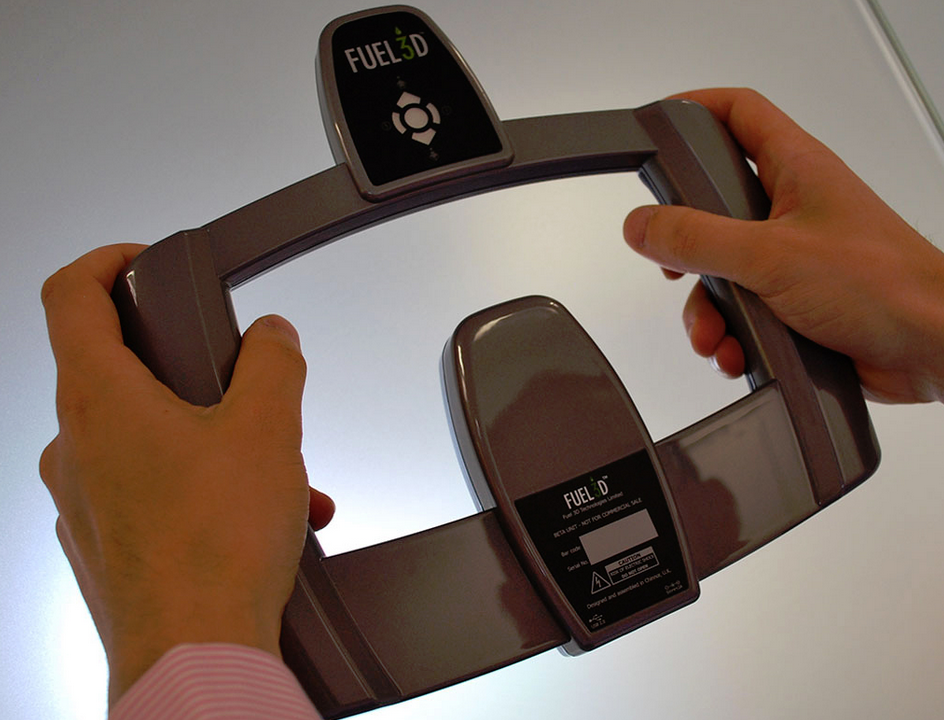

In 2013, Fuel3D raised more than $300,000 for the development of an affordable, high-resolution handheld 3D scanner through its successful crowdfunding campaign on Kickstarter.

The company has expanded in response to global demand and now has distributors in 23 countries around the world as well as manufacturing operations in Asia.

With its commercial launch expected in early 2015, the Fuel3D scanner is currently in beta testing with the company’s Kickstarter backers.

Stuart Mead, CEO of Fuel3D says that the funding round will take Fuel3D through the full commercial launch of our scanner next year, and will allow the company to invest in new talent and infrastructure, including growing its operations in the United States.

He adds, ‘In tandem with our consumer product development, we will also be using the funding to further develop our intellectual property so that we can capitalise on the ongoing interest we receive from international brands in applying our technology in new verticals beyond 3D printing.’